Follow along: Newsletter | Facebook | Instagram

Did interest rates go up?

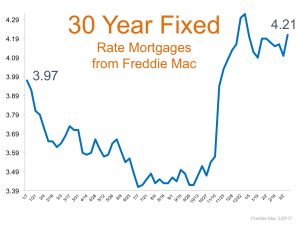

You probably saw the recent news on the Federal Reserve raising the Federal Fund Rate by 25 basis points (one quarter of a percent). But what does that mean? The small rate hike was anticipated, and is widely thought to indicate confidence in the US economy.

You probably saw the recent news on the Federal Reserve raising the Federal Fund Rate by 25 basis points (one quarter of a percent). But what does that mean? The small rate hike was anticipated, and is widely thought to indicate confidence in the US economy.

What does it mean for your home and mortgage?

Aside from home equity lines of credit, or mortgage products like an adjustable rate mortgages (A.R.M.) the Fed decision will not affect your current mortgage payment. For those consumers currently in the market for a new home mortgage the news shouldn’t come as a surprise, and its effect is only very small. On average, a new $300,000 mortgage will likely cost borrowers approximately $60 more a month. On the flipside, the stronger economy that led to the interest rate announcement probably means there’s a more stable and competitive work environment.

Our take:

If we look to the past, rates are still historically low. Over the past 46 years, they’ve been at an average 8.25% — nearly double where they are today. The most recent change isn’t likely to prevent those in the market from purchasing, but continued increases will. What’s more likely to slow the housing market is the limited number of homes currently for sale. People who were on the fence about whether or not to buy or “move up” might start deciding to stay put. This potential trickle down effect is likely to continue to contribute to a lack of inventory.

If we look to the past, rates are still historically low. Over the past 46 years, they’ve been at an average 8.25% — nearly double where they are today. The most recent change isn’t likely to prevent those in the market from purchasing, but continued increases will. What’s more likely to slow the housing market is the limited number of homes currently for sale. People who were on the fence about whether or not to buy or “move up” might start deciding to stay put. This potential trickle down effect is likely to continue to contribute to a lack of inventory.

Our SunCrest Market Update is a hyper-local analysis of the most up-to-date information regarding the SunCrest real estate market. The previous month’s SunCrest housing information and future editions are released monthly.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link